Bank Muamalat Hire Purchase-i. 1 Buyer choose model 2 Contact car seller arrange for appoinment 3 Ready all required documents 4 Appointment with consultant at your door step 5 Documents submitted for loan processing 1 2 working days 6 Interview by bank 1 2 working days.

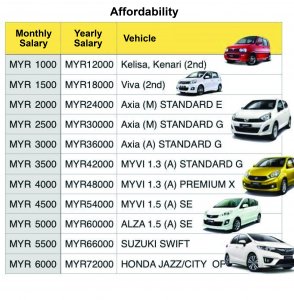

What Car Can You Really Afford With Rm 5 000 Monthly Salary

150000 lakhannum for car loan.

. To be eligible applicants must be earning at least RM30000 annual base salary without bonuses for workers and have an employmentbusiness visa. Letter of appointment or confirmation letter stating salary and other income. Pursuing a degree in a recognised institution of higher learning.

Blacklisted person usually. If not you still need a guarantor. For all approved car models.

RM4500 RM1000 RM4500 x 100 22. The salary is RM900 per month and 15 of the. Here is the procedure and steps or flow when you buy a new car in Malaysia.

The eligibility for loans like car loans housing loans and other personal loans all these loans. Most car loans in Malaysia have a maximum margin of financing of 90 so you should always expect to pay at least 10 upfront to the car dealer. Now the new commitment installment should be in the range of RM3500- RM1350 RM2150.

AmBank Arif Hire Purchase-i. 60000 per annum if you are looking to buy a standard car and at least Rs. Latest 2 year ITRs and audited financial of 2 years along with computation of income.

35 x RM 70000 x 5 RM 12250. Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period. RM98820 90 margin Loan Period.

To apply for car loan you must have a salary of at least 3 times the monthly payment of the car. Maximum 60 years of age at maturity conditions apply Minimum Net Annual Salary of Rs. Eligibility for Car Loan Salaried individuals who are eligible for a car loan.

RM10980 10 margin Applied Loan Amount. Public Bank Aitab Hire Purchase-i. Paycheck stubs from the previous 3 months.

Income eligibility based on latest salary slip and Form 16. Car Loan Interest Rates. This however is subjective as each bank has different requirements so its best to check with them before.

To illustrate further see the car loan calculator below to see how much you are borrowing and committing every month when purchasing a new Proton X70. You are required to pay a minimum down payment of 50 of the cars total value. Latest tax return form less than one year old For salaried employees.

Latest salary slip and Form 16. Hong Leong Auto Loan. If the fresh grad is to put a downpayment of 10 and take a five-year loan with an estimated interest rate of 3 they would be paying roughly RM404 per month RM303 for a seven-year loan or RM247 for a nine-year loan.

Earn at least Rs. RM500 car loan RM200 PTPTN RM300 credit card RM1000. The value of the car you should buy with a loan should equate to monthly payments that dont exceed 15 of your monthly salary loan repayment period must not exceed 5 years.

Minimum of 1 year continuous employment. - If its RM65000 - an approved loan is RM59900. Take note that car loans with margin of financing of 100 do exist though they are offered.

Minimum 21 years of age. Photocopy of passport. If you can afford it consider paying a higher percentage upfront which will in turn lessen your principle loan amount as well as your interest.

The deposit payment of any car purchase is usually 10 of the total car price. For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of. In terms of documentation you are required to have obtain Certificate of Entitlement COE Vehicle Quota System VQS and Electronic Road Pricing ERP which all cost a lot of money before you actually earn the eligibility to own a car.

Here is how your total interest monthly interest and monthly installment will be calculated based on the formula above. Let us examine the effectiveness of this tip. Aged between 21 - 30 years old.

Total monthly commitments. Employed for at least 1 month with a minimum salary of RM2500. RM5000 x 5 RM250 For the credit card the bank will multiply with 5 from the total outstanding amount Total existing commitment.

Self-employed individuals who are eligible for. The bank only provide 90 loan unless you are a government staff and university graduated person. Alliance Bank Hire Purchase.

Most banks require credit card applicants to have an account with the bank and have a fixed deposit of at least RM5000. Aged between 18 - 30 years old. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount.

If its RM55000 an approved loan is RM55000. When applying for a loan banks will only allow you to borrow up to a certain amount of your DSR. For those with less than 6 months of employment applications can still be considered if parents or siblings serve as guarantor.

RM600 Credit Card total outstanding. Salaries in malaysia range from 1670 myr per month minimum salary to 29400 myr per month maximum average salary actual the median salary is 6450 myr per month which means that half 50 of the population are earning less than 6450 myr while the other half are earning more. For an expat to apply for a loan they should make sure they have these documents.

0 Comments